Asus

![]()

Journalist

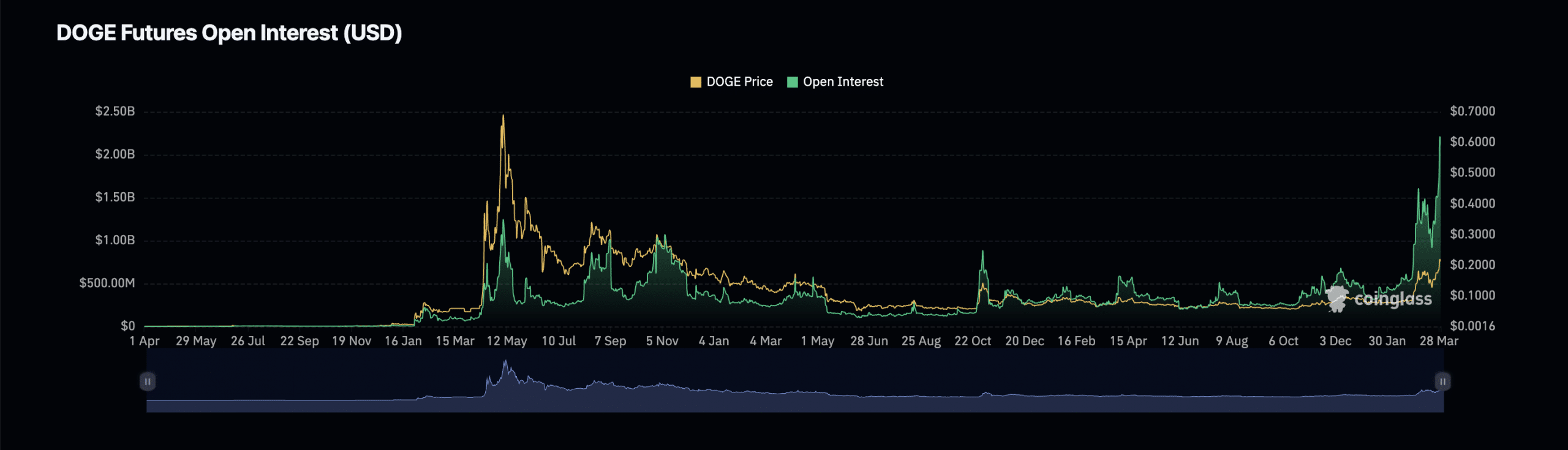

- Dogecoin’s Futures Open Interest has rallied to a new all-time high.

- Key indicators on a daily chart suggested a further growth in the altcoin’s price.

Dogecoin’s [DOGE] Futures Open Interest has rallied above $2 billion to a new all-time high, according to Coinglass data. As of this writing, the memecoin’s Futures Open Interest totaled $2.21 billion, having risen by over 100% since the beginning of March.

Source: Coinglass

When an asset’s open interest rises in this manner, it means that the number of open positions in that asset has increased. This signals a surge in market activity as more traders open new positions or maintain existing ones.

It also indicates an inflow of more liquidity into the asset’s derivatives market.

AMBCrypto found that since the general market rally began in October 2023, DOGE’s Funding Rates across cryptocurrency exchanges have been positive.

This has remained so despite the price decline witnessed between the 15th and 20th of March due to the general market pullback that occurred during that window period.

When an asset records a rise in its Futures Open Interest and positive Funding Rates, it is a bullish signal. This indicates that future market participants have continued to open trade positions in favor of a price rally.

DOGE wants to extend its gains

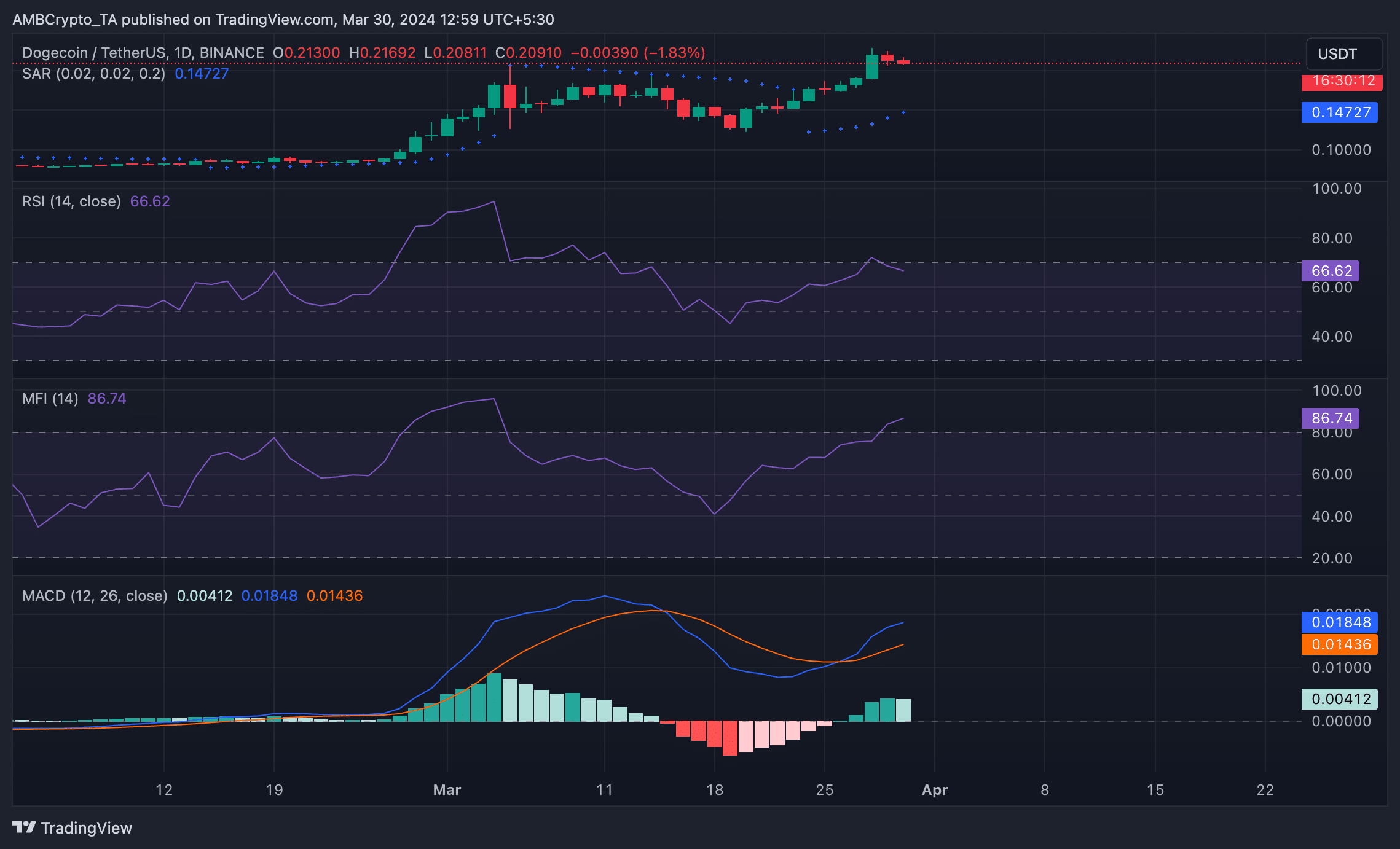

At press time, DOGE traded at $0.21. Per CoinMarketCap’s data, the memecoin’s value has risen by 30% in the last week. AMBCrypto’s assessments of its price movements on a 1-day chart revealed that the memecoin was poised to extend the seven-day rally.

For example, readings from its Moving Average Convergence/Divergence (MACD) indicator showed that the coin’s MACD line crossed above the signal line on 26th March. This is a bullish signal, and traders often interpret it as a sign to take long positions.

Further, the DOGE’s price growth in the last week has been supported by demand for the altcoin.

Its key momentum indicators rested above their respective neutral lines at the time of writing, indicating that traders preferred to accumulate the meme coin rather than sell their holdings for profit.

The values of DOGE’s Relative Strength Index (RSI) and Money Flow Index (MFI) were 66.98 and 86.77.

Is your portfolio green? Check out the DOGE Profit Calculator

Lastly, the coin’s price rested above its Parabolic SAR indicator. Traders use this indicator to make informed decisions about entering or exiting positions in the market.

When an asset’s price is above the dotted lines of this indicator, it indicates that the bullish momentum is strong and that any rally in its price is likely to continue.

Source: DOGE/USDT on TradingView