Asus

The current information from IntoTheBlock suggests that Dogecoin’s network activity has actually experienced a substantial decrease over the previous week, even as the rate of the cryptocurrency has actually been increasing dramatically.

To examine whether this pattern is a sign of a bullish or bearish market belief, the analysis depends on blockchain information and insights supplied by IntoTheBlock, an important crypto tool that focuses on drawing out and evaluating information straight from blockchain networks.

Dogecoin’s Dilemma: Facing a Price Correction or Poised for 30% Gain?

The present state of Dogecoin (DOGE) in the everyday chart shows a highly bullish pattern. The cryptocurrency has actually effectively gone beyond the golden ratio resistance near $0.082, reaching a brand-new high. This accomplishment efficiently concludes the previous restorative stage. Dogecoin is now coming across the next considerable Fibonacci resistance level around $0.093.

Ought to Dogecoin break through this resistance, there is capacity for an extra 30% boost in rate, targeting the golden ratio level at around $0.12. Supporting this bullish outlook, the Moving Average Convergence Divergence (MACD) pie chart is trending upwards, and the MACD lines remain in a bullish crossover.

The Exponential Moving Averages (EMAs) show a golden crossover, strengthening the bullish pattern in the brief to medium term. The Relative Strength Index (RSI) is showing a bearish divergence, which may lead to a restorative rate motion in the near future.

If a correction in DOGE’s rate happens, the next substantial Fibonacci assistance levels are expected at around $0.078 and $0.07, respectively.

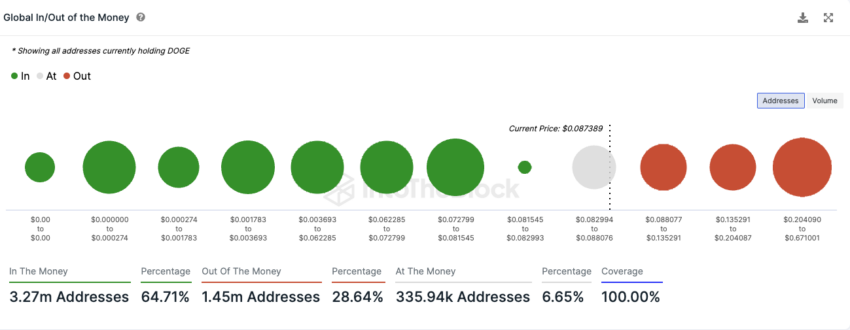

Over 60% of Dogecoin Addresses Profitable: A Positive Trend

Presently, around 65% of Dogecoin (DOGE) wallet addresses remain in a rewarding position, indicating they remain in the ‘green zone.’ Alternatively, about 29% of these addresses are experiencing a loss, putting them in the ‘red zone.’

Almost 6.7% of DOGE holders are in a break-even circumstance, where offering their DOGE tokens at the existing market rate would neither result in a revenue nor a loss.

This circulation of revenue and loss amongst DOGE holders shows the cryptocurrency’s current market efficiency and rate changes.

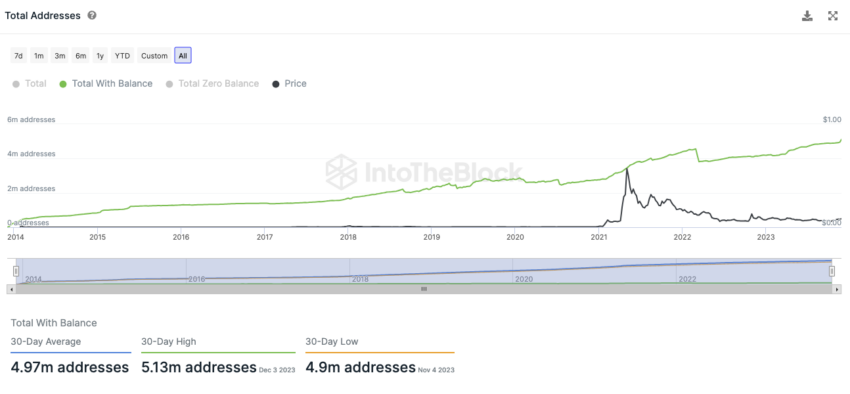

Growth on the Horizon: The Dogecoin Network Experiences Growth

The Dogecoin network is displaying indications of development. Over the previous 30 days, the typical count of addresses holding Dogecoin (DOGE) balances was around 4.97 million. At a particular point within this duration, the number even reached around 5.13 million addresses.

This information suggests a boost of about 50,000 addresses given that the last analysis was performed. Such an uptick in the variety of addresses with DOGE balances recommends a broadening user base and growing interest in Dogecoin, showing favorable characteristics within the Dogecoin neighborhood and network.

Dogecoin Network Sees Sharp Decline in Activity Over Past Week

The Dogecoin network has actually experienced a considerable decrease in activity over the previous week. This slump is evidenced by a more than 51% decrease in the variety of active DOGE addresses. Such a sharp reduction suggests a significant drop in deals or motions including Dogecoin.

In addition, there has actually been an approximately 67% decline in developing brand-new DOGE addresses throughout this duration. This significant fall recommends a downturn in the increase of brand-new individuals or financiers in the Dogecoin market.

There has actually been a decrease of around 16% in the number of addresses that do not hold any DOGE balances. This decrease might show a motion of inactive or non-active addresses either ending up being active or being closed.

In general, these data point towards a considerable decrease in both involvement and interest in the Dogecoin network over the previous week, marking a stage of reduced activity and engagement within the Dogecoin environment.

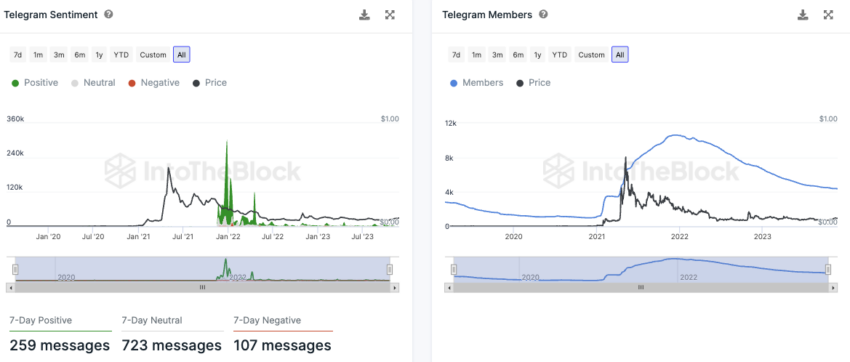

Dogecoin Sentiment on Telegram: Predominantly Positive Vibes

The belief surrounding Dogecoin on Telegram channels seems primarily favorable, as shown by the variety of newspaper article. There have actually been almost 259 favorable news pieces about Dogecoin. Which is more than double the count of unfavorable news, which is around 107 stories.

This variation recommends a normally beneficial understanding or reception of Dogecoin within the Telegram neighborhood or amongst users who go over cryptocurrencies on the platform.

Regardless of this favorable news protection, the Dogecoin Telegram group has actually experienced a noteworthy decline in its subscription considering that the end of 2021. This decrease in group members may recommend a subsiding interest or engagement amongst the neighborhood, regardless of the favorable news story.

It might likewise show more comprehensive patterns in the cryptocurrency market or shifts in the methods individuals pick to collect info and talk about digital currencies.

Over One-Third of Dogecoin Supply Held by Retail Investors

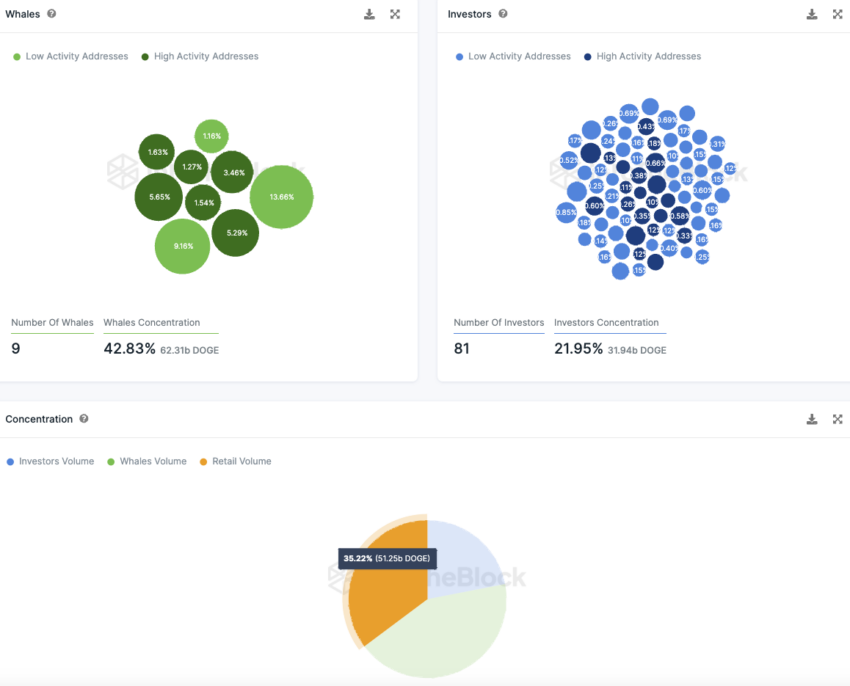

The ownership circulation of Dogecoin exposes a significant concentration amongst big financiers and whales. Particularly, there have to do with 81 big financiers, each having in between 0.1% and 1% of the overall Dogecoin tokens.

Jointly, these financiers hold around 22% of the whole Dogecoin supply. This shows a considerable part of the cryptocurrency remains in the hands of a fairly little group.

There are 9 whale addresses in the Dogecoin network. These whales are especially notable as each of them owns a minimum of 1% of the overall Dogecoin supply. Which cumulatively represents almost 43% of it.

This concentration of ownership in whale addresses highlights a significant element of Dogecoin’s ownership structure. Where a little number of entities manage a considerable portion of the overall supply.

The staying share of Dogecoin, totaling up to about 35.22%, is held by little financiers. These are addresses that each hold less than 0.1% of the Dogecoin tokens and are categorized as retail financiers.

This sector represents the wider base of specific or smaller-scale holders within the Dogecoin community.

Disclaimer

In line with the Trust Project standards, this rate analysis post is for educational functions just and ought to not be thought about monetary or financial investment suggestions. BeInCrypto is devoted to precise, impartial reporting, however market conditions undergo alter without notification. Constantly perform your own research study and seek advice from an expert before making any monetary choices.