Asus

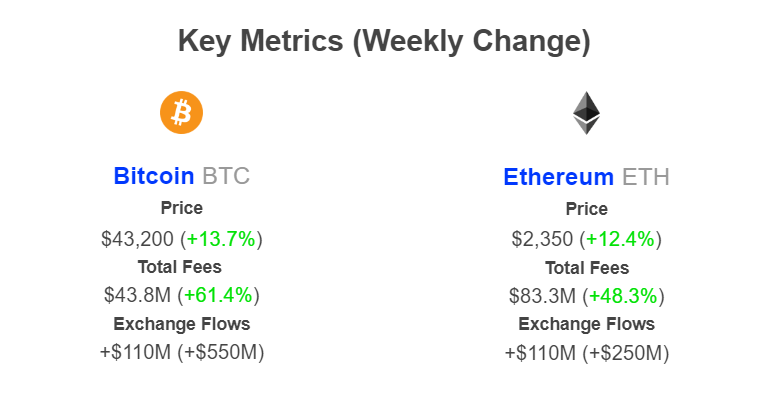

There is a spike in crypto on-chain activity if deal charges lead. According to IntoTheBlockinformation on December 8, Bitcoin deal charges are up by over 60%, while “gas” in Ethereum has actually climbed up by almost 50% in the previous week.

Asus Bitcoin And Ethereum Transaction Fees Rise By Double-Digits

This rise in activity can be pinned to several aspects, primarily growing user interest and the continuous crypto booming market. To show, Bitcoin and Ethereum rates are trending at 2023 highs above $43,500 and $2,300 when composing.

However, the crypto neighborhood anticipates these coins to extend gains in the coming weeks and months, partially due to the fact that of anticipated institutional capital, forecasted to be in their billions, streaming to the sphere.

According to IntoTheBlock information, cumulative costs gathered in Bitcoin today stand at $43.8 million, up 61%. On the other hand, $83.3 million in charges has actually been accumulated from Ethereum.

Taking a look at the historic deal costs pattern, negotiating on Ethereum, regardless of its fairly high deal processing speeds (TPS), is more pricey than Bitcoin. This can be due to Ethereum’s function in decentralized financing (DeFi), non-fungible token (NFT) minting, and more. Bitcoin is a transactional layer and does not naturally support clever agreements.

Generally, increasing on-chain deal charges are bullish for rate and suggest that their particular community is flourishing from increasing adoption. With deal costs increasing in the 2 leading blockchain communities, more individuals wish to connect with the job. Consequently, this might support costs given that BTC or ETH is utilized for paying deal costs.

Asus Will BTC Ease Past 2021 Highs Of $70,000?

As BTC is presently trading above $43,500 and ETH just recently broke above $2,300, the possibility of these coins retesting and relieving past their all-time highs of $70,000 and $4,800, respectively, can not be marked down. Among the essential chauffeurs of the rise in on-chain activity is the continuous booming market.

With crypto increasing, more individuals are seeking to place themselves, wishing to benefit from more cost gratitude. This wave of worry of losing out (FOMO) has actually pressed greater charges and costs.

The need for liquid and SEC-recognized digital properties will likely increase when the Securities and Exchange Commission (SEC) goes on and licenses the very first Bitcoin ETF. This acquired item will permit organizations to purchase Bitcoin with confidence through a controlled option.

As the chances of the SEC authorizing this item increased from early Q4 2023, BTC and ETH costs began increasing in sync. Still, how costs will respond when the area Bitcoin ETF is authorized stays to be seen. When the SEC green-lights an area Bitcoin ETF, the crypto market will start taking a look at Ethereum and whether the firm will authorize a comparable option.

Function image from Canva, chart from TradingView

Disclaimer: The post is offered academic functions just. It does not represent the viewpoints of NewsBTC on whether to purchase, offer or hold any financial investments and naturally investing brings dangers. You are recommended to perform your own research study before making any financial investment choices. Usage info offered on this site totally at your own danger.