Asus

The approval of 11 spot Bitcoin exchange-traded funds (ETFs) in the US has set the stage for a flood of billions into the crypto market, boosting liquidity. Despite a slight dip on Saturday, Bitcoin is holding strong.

Will Bitcoin Hit $300K Shortly?

In a recent X post, seasoned crypto analyst Michaël van de Poppe delves into the profound impact of the approved Spot ETF. Analyst decodes the ETF approval as a transformative event, similar to milestones in the cryptocurrency’s 15-year history. Emphasizing a gradual impact over months to years, he envisions Bitcoin reaching $300,000 in the ongoing cycle.

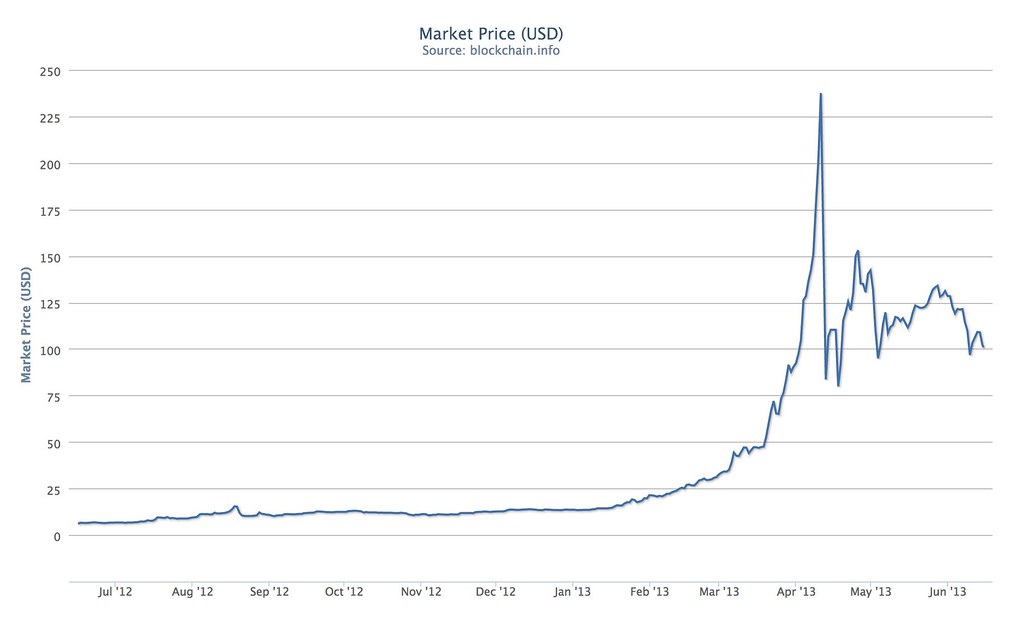

Van de Poppe also parallels the current market cycle and the 2013-2017 cycle, positioning the present stage akin to January- March 2016. According to the analyst, there is a consolidation period of 3-6 months for Bitcoin before witnessing new highs. He further predicts an altcoin rally during this time, offering investors alternative opportunities during Bitcoin’s consolidation.

He highlights how institutional involvement is important, seeing a substantial net inflow of over $600 million on the ETF’s first day. He discerns this institutional phase as a precursor to retail participation, advising a strategic focus on altcoins during the anticipated Bitcoin consolidation.

Having said that, he also believes that soon there will be a large influx of money from Wall Street, ranging from $2 trillion to $4 trillion, which could boost Bitcoin’s value to a range of $130,000 to $250,000. The impact on market capitalization is substantial, with a higher impact linked to lower supply availability.

Moreover, there will also be a short-term cooling-off period for Bitcoin, citing factors such as rotations from Grayscale Bitcoin Trust and institutional compliance measures. For investors, Van de Poppe he recommends a straightforward strategy: buying the dip and staying vigilant during market corrections, especially if Bitcoin experiences a 20% or more correction.

Current Market Scenario

Altcoins are set to thrive in the next few quarters as Bitcoin gears up for a significant rally, injecting much-needed liquidity into the market. Expect Bitcoin’s dominance to keep decreasing, possibly falling below 30 percent in the next two years. The growing popularity of layer one blockchains supporting smart contracts and web3 protocols is also drawing more investors into the crypto space.

Was this writing helpful?

No Yes

Zameer Attar

Zameer is a financial analyst and writer with a particular interest in cryptocurrency markets. He has been studying cryptocurrencies and their market behavior for several years and deeply understands the factors that affect the price of cryptocurrencies. His expertise lies in his ability to use both technical and fundamental analysis to make informed predictions about the future direction of cryptocurrency prices. He has a strong understanding of market sentiment and uses this to inform his trading decisions and price predictions.