Asus

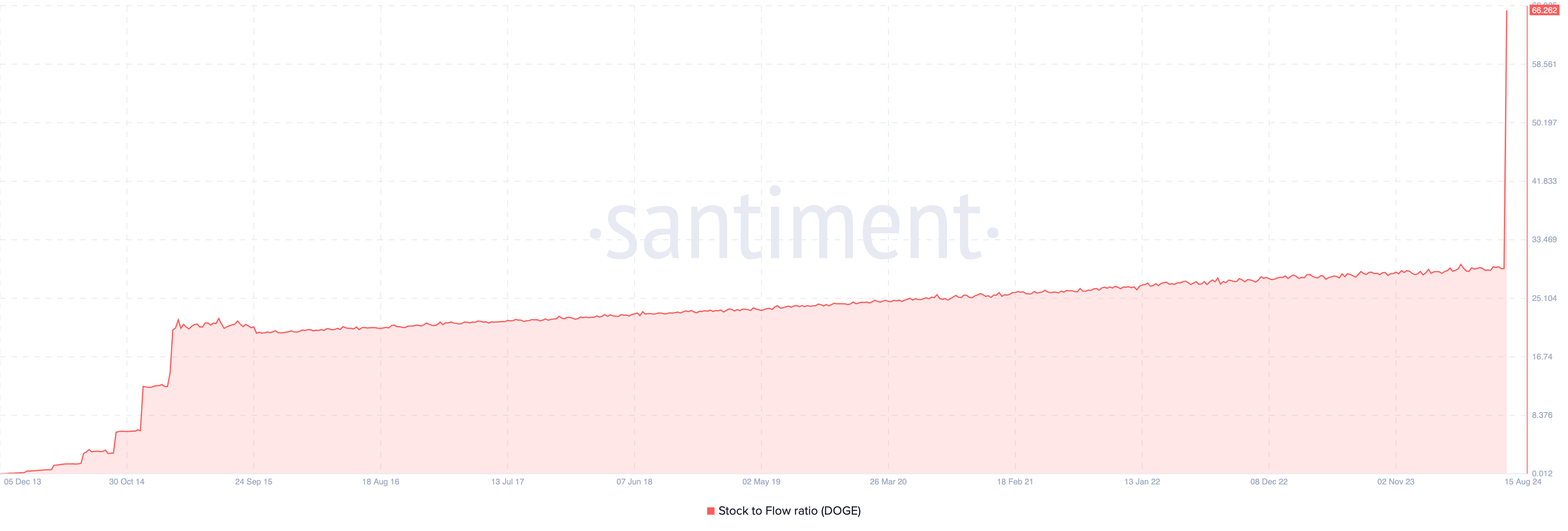

Between August 18 and 19, Dogecoin (DOGE) saw an astonishing spike in its stock-to-flow ratio. This sudden increase marks a notable shift for the meme coin, whose price has struggled to produce gains for some time.

At press time, DOGE changes hands at $0.099, representing a 40% decrease over the last 90 days. But the coin could be on the cusp of a major price rally. Here is how.

Dogecoin Seems Bull Run Ready

The stock-to-flow ratio is a model in the market that measures the scarcity of a cryptocurrency. For instance, if the ratio drops, it means that there is high inflation around the coin, and the price risks dropping.

According to Santiment, Dogecoin’s stock-to-flow ratio jumped to 69.25 — an all-time high for the metric. This unusual spike is a positive signal for DOGE’s price, as it hints at a supply squeeze for the cryptocurrency.

In crypto, a supply squeeze occurs when demand for a coin increases during a scarcity period. Therefore, based on the laws tied to the metric, the DOGE price may encounter a notable rally in the coming weeks.

Read more: Dogecoin vs. Bitcoin: An Ultimate Comparison

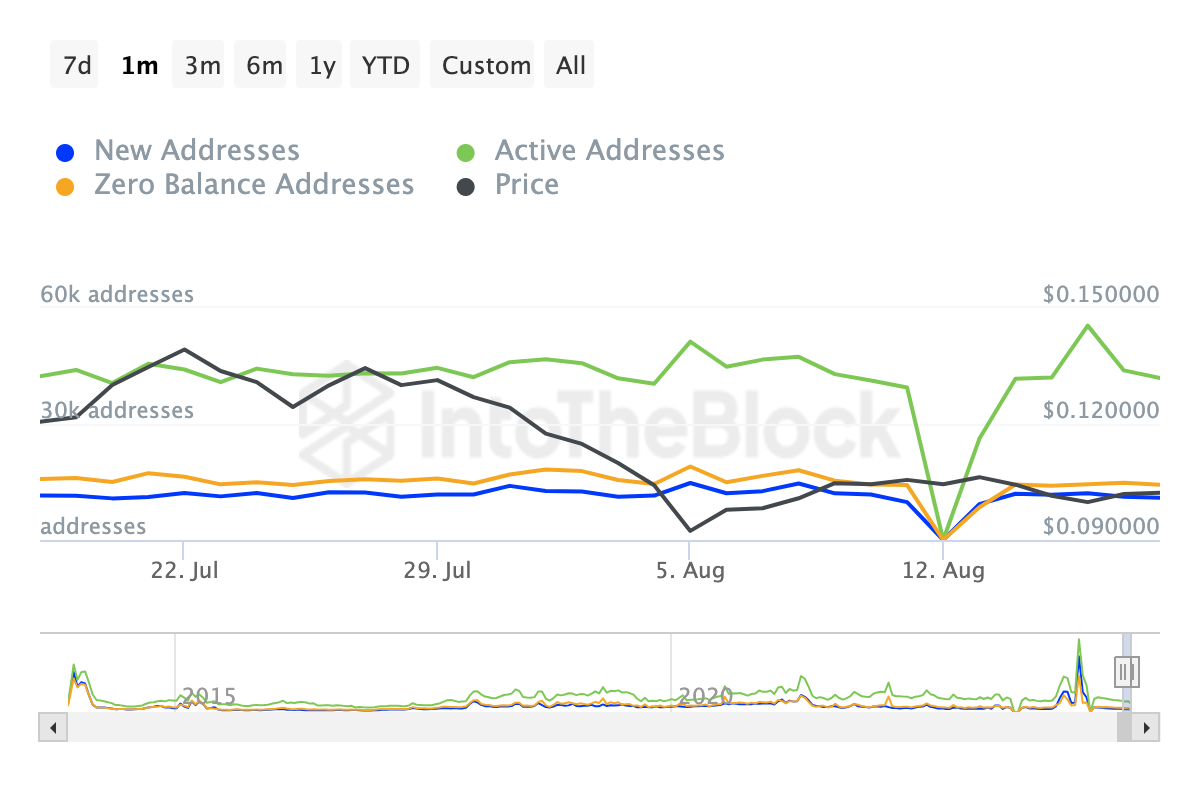

Beyond this surge, both active and new addresses on Dogecoin’s network have risen since last week. Active addresses reflect the number of users completing transactions, indicating increased blockchain usage and a bullish outlook. A decline would signal a bearish trend.

New addresses track participants making their first transaction, with growth suggesting rising adoption and demand. Conversely, a drop would indicate waning interest.

Therefore, the jump in the active and new addresses on DOGE reinforces the forecast that the coin price may soon exit the long-standing bearish trend.

DOGE Price Prediction: Big Gains Ahead

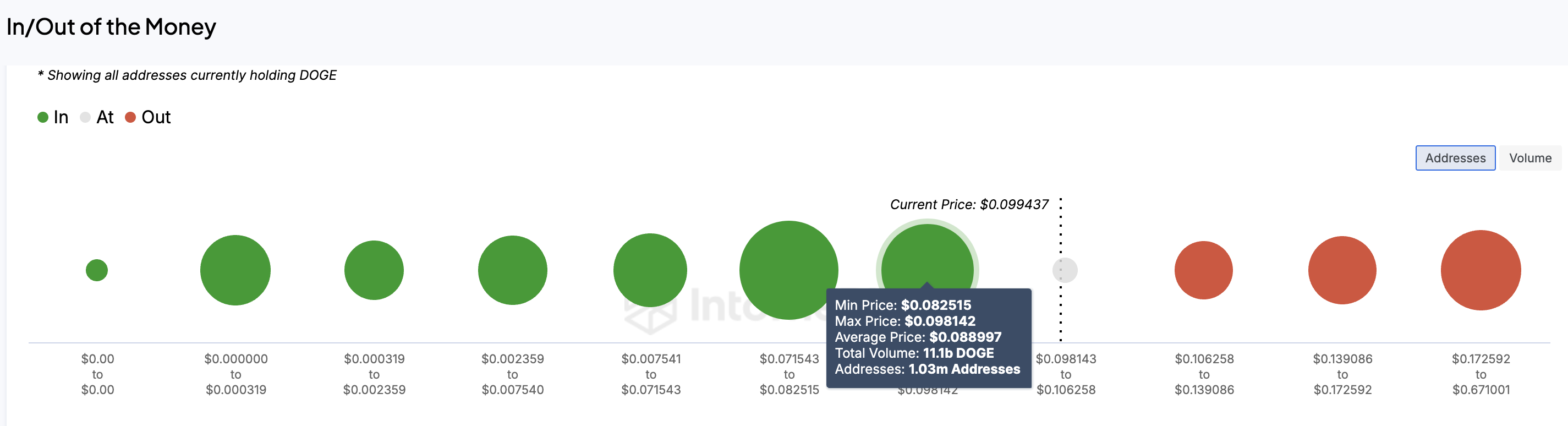

To analyze Dogecoin’s next move, BeInCrypto examines the Global In/Out of Money (GIOM) indicator. This tool shows whether addresses are in profit, at a loss, or breaking even based on their acquisition cost versus the current price.

Addresses with a higher cost basis than the current price are out of the money, while those with a lower cost basis are in the money. The GIOM helps identify key support and resistance levels; more addresses in profit create support, while those at a loss contribute to resistance.

Currently, over 1 million addresses purchased 11 billion DOGE at a maximum price of $0.098.

Read more: Dogecoin (DOGE) Price Prediction 2024/2025/2030

This figure is higher than the number that accumulated between $0.12 and $0.15. Therefore, if buying pressure increases, DOGE may break above the resistance around these points.

If successful, the price may climb to $0.15, representing an approximately 50% increase. However, failing to clear this resistance or facing rejection could invalidate the bullish outlook. In such a scenario, DOGE’s price might drop to $0.088, indicating potential downside if momentum shifts.

Asus Trusted

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.