Asus

Anticipation is at a high degree as the 2024 Bitcoin Conference draws near, driven not just by technical developments but also by the surprising backing of an influential person: Donald Trump.

The surprising acceptance of Bitcoin by the former president may change the crypto scene and throw lengthy shadows over political debate and market projections. Here is a look at how Trump’s potential presidency can impact the direction of the crypto.

Asus The Bitcoin Turnaround Of Trump

Once a strong opponent of Bitcoin, Donald Trump has changed his language dramatically. Even suggesting Bitcoin as a possible reserve currency alongside the US dollar, his campaign has aggressively embraced the digital asset. This fresh zeal differs greatly from his past posture, where he wrote out Bitcoin as a “scam.”

In recent discussions, the former president has labeled Bitcoin as “digital gold.” His campaign vows to boost the digital asset’s acceptability. This might give companies and investors more confidence, adding more appeal to Bitcoin.

Asus Regulatory Change And Economic Effects

Trump’s possible impact on Bitcoin is mostly dependent on his attitude to regulation. Given JD Vance’s pro-crypto posture, Trump’s choice of running mate suggests a likely tsunami of favorable crypto laws. Clearer rules and more institutional Bitcoin investment might find their path in this regulatory climate.

Another important element for the dynamics of Bitcoin’s price might be Trump’s economic plans. His platform emphasizes on lowering inflation and enhancing economic stability—qualities that directly influence the value of Bitcoin.

Trump’s economic policies were blamed with a somewhat consistent investment environment over his past presidency. Should he be successful in fostering a better economic climate, Bitcoin would gain from more liquidity and investor confidence.

Conjecture And Market Responses

The market for Bitcoin is driven by speculation, hence Trump’s close relationship with the crypto asset has magnified this influence. Recent events, like the attempted murder of Trump, have demonstrated how drastically market mood may respond to political changes. After the episode, the crypto enjoyed a big surge; meme coins and market mood reflected the great stakes of Trump’s involvement.

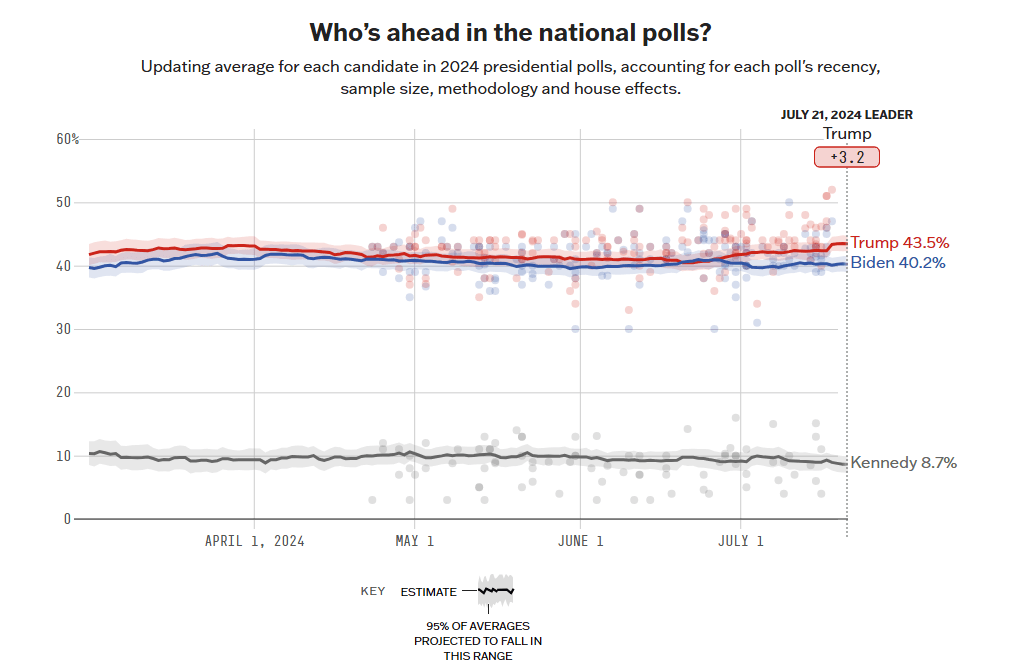

Meanwhile, post-assassination attempt, the former commander in chief’s ratings against Biden rose somewhat (see chart below).

Trump’s erratic political path fuels even more conjecture about his possible administration. The result of the election is still unknown even if Kamala Harris is becoming a strong competitor. Harris’s opinion on Bitcoin might potentially affect market dynamics, therefore adding even another level of intricacy to the future of the currency.

Analyses disagree on the possible effect of a Trump win on the price of Bitcoin as the election gets near. While some see a positive trend with Bitcoin maybe skyrocketing above $100,000, others remain wary expecting firmer indications from Trump’s campaign and plans.

BTC Price Forecast

Technical signs show Bitcoin will rise significantly in the following week. The cryptocurrency is trading 33% below our monthly projection, predicting a comeback if market circumstances improve. Bullish indications like a rising moving average and a stronger Relative Strength Index (RSI) imply BTC might rectify its undervaluation and reach the forecasted price goal.

Bitcoin’s expected three-month rise of 536% and six-month growth of 53% shows investor confidence. Analysts expect a 148% growth in BTC over one year, indicating its long-term potential. Positive trendline breakouts and solid support levels back this projection. Institutional interest and favourable macroeconomic conditions might boost Bitcoin’s price in the long run.

Featured image from Getty Images, chart from TradingView

Disclaimer: The information found on NewsBTC is for educational purposes

only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any

investments and naturally investing carries risks. You are advised to conduct your own

research before making any investment decisions. Use information provided on this website

entirely at your own risk.