Asus

The cryptocurrency market has experienced increased volatility in recent days, and the Shiba Inu token is one affected asset. Over the weekend, the price of Shiba Inu plunged to around $0.000018, a staggering 25% drop from its intraday high of $0.00002492.

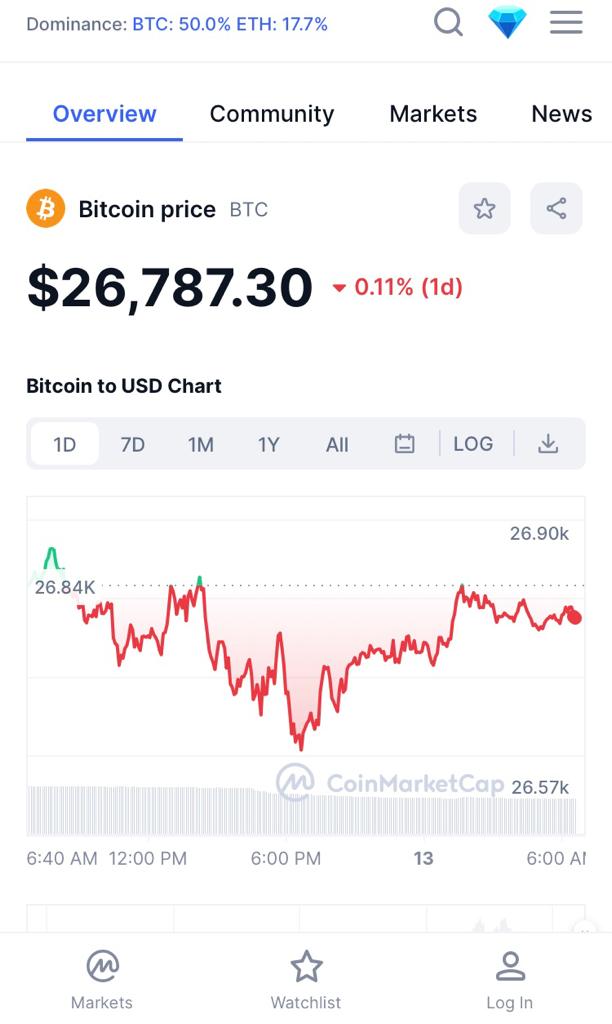

This sharp decline was primarily driven by Bitcoin’s retest of the $60,000 range amidst intensifying global conflicts, which dragged the broader crypto market down.

Bullish Investors Buy the Shiba Inu Dip

Despite the bearish trend, a prominent crypto investor, Oscar Ramos, has declared his intention to capitalize on the recent SHIB price dip. Ramos, a self-proclaimed Bitcoin investor, revealed on social media that he plans to increase his Shiba Inu holdings by taking advantage of the current low prices.

In addition to SHIB, Ramos also disclosed his plans to buy other cryptocurrencies, including Bitcoin, XRP, Solana, CRO, BRETT, and JASMY, during this market downturn.

Ramos’s declaration shows his robust confidence in Shiba Inu’s ability to stage a notable comeback. Indeed, the meme coin has already started to recover, with its price climbing back to $0.00002351, marking a 28.47% gain from the recent low.

Market analysts, such as Maximilian on TradingView, have also expressed optimism about Shiba Inu’s prospects. Maximilian has argued that SHIB could soon reclaim the $0.000031 price level.

He cites factors like the stability of SHIB whale and shark holdings, including a consistent rise in trading volume. While the latter factor has since faltered, the analyst predicts a potential 300% rally in a single day. This could push SHIB beyond the $0.00003 mark.

Factors Driving Shiba Inu’s Potential Comeback

Several factors are contributing to the belief that Shiba Inu could stage a notable comeback. Firstly, the stability observed in SHIB whale and shark holdings suggests a potential foundation for the token’s price recovery. Also, the consistent rise in trading volume indicates growing investor interest and demand for Shiba Inu.

The Shiba Inu ecosystem has been actively developing and expanding, introducing new utility and use cases for the token. This ongoing development and integration of SHIB into various decentralized finance (DeFi) and non-fungible token (NFT) projects have reinforced the token’s long-term viability and potential for growth.

Again, Hong Kong’s securities regulator, the SFC has reportedly approved the city’s first spot in the Bitcoin exchange-traded funds. The SFC has reportedly provided the official announcement to confirm these reports, though the details have yet to be made public.

The launch of this spot Bitcoin ETF is anticipated to bolster Hong Kong’s status as a leading hub for cryptocurrency trading and investment. The ETF is expected to attract significant investor interest and generate up to $25 billion in demand for Bitcoin-traded funds.

The news of the spot Bitcoin ETF approval in Hong Kong has immediately impacted the cryptocurrency market. Bitcoin’s price has rebounded, surging past the $66,500 mark after dropping to under $59,000 over the weekend.