Asus

Bitcoin has hit the $60,000 price mark, recovering a price level last seen since August 29. Based on data from CoinMarketCap, The crypto market leader moved by 3.98% on Friday, capping off a rather impressive weekly performance. Commenting on this price gain, prominent blockchain analytics company Santiment has provided insight into shifting market dynamics that may result in a sustained price rally for Bitcoin and other cryptocurrencies.

Asus Bitcoin Accumulation, Exchange Outflow Signal Bullish Sentiment

In an X post on Friday, Santiment shared key developments in the BTC market that could encourage retail investors’ participation in the coming weeks.

The on-chain analytics team reported consistent levels of massive accumulation from BTC whales and sharks. When large-scale investors such as these consistently purchase a massive amount of an asset, especially during downturns or turbulent periods, it indicates confidence in the asset’s long-term profitability.

🥳 Bitcoin is within inches of regaining the coveted $60K market value for the first time since falling below back on August 29th. The dynamic duo of mid-term accumulation from sharks & whales, and falling levels of BTC on exchanges, sets the stage for crypto to roll again. pic.twitter.com/LHyxaK4Rci

— Santiment (@santimentfeed) September 13, 2024

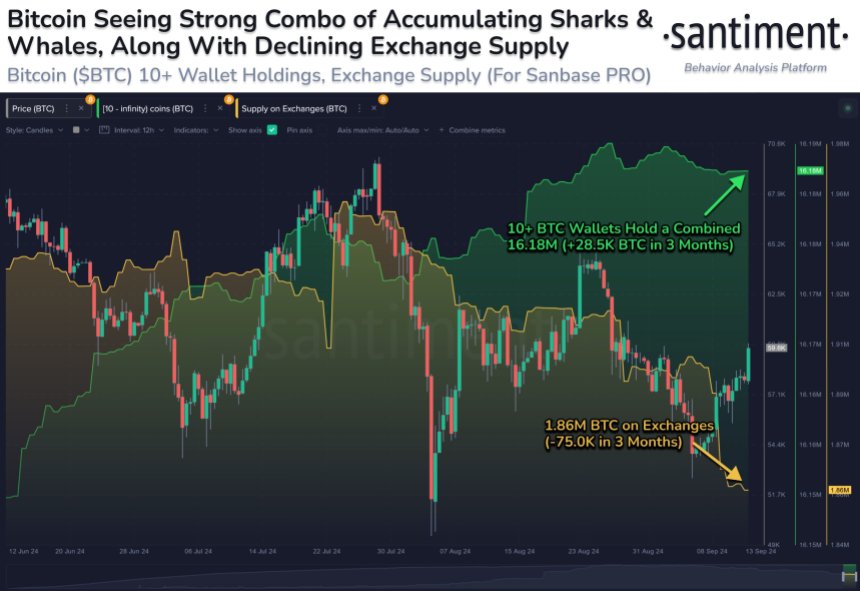

According to Santiment, Bitcoin sharks and whales i.e. wallets holding 10 BTC and above, have acquired 28,500 BTC in the last three months bringing their total holdings to 16.18 million BTC, valued at $978.29 billion.

Aside from this encouraging accumulation trend, Santiment has also noted a decline in Bitcoin supply on exchanges. For context, an increase in exchange balances of an asset indicates investors are cautious and selling or preparing to sell their holdings. The opposite of such a scenario means that investors are moving their holdings to self-custodial wallets, likely in anticipation of a price rise.

Based on Santiment’s report, approximately 75,000 BTC, valued at approximately $4.54 billion, has been withdrawn from exchanges in the last three months, bringing the current total exchange Bitcoin balance to $1.86 million BTC. Santiment concludes that the combination of these two factors i.e. constant accumulation by big investors and a decrease in exchanges BTC supply indicate that Bitcoin and the crypto market at large are gathering momentum for a massive price rally.

Asus Massive Bullish Divergence Signals Potential Altcoin Rally

In other news, crypto analyst Michël van de Poppe has noted a large weekly bullish divergence on TOTAL3/BTC, a trading chart that tracks the combined value of all altcoins excluding Ethereum in BTC.

This bullish divergence largely indicates that selling pressure is weakening and altcoins are about to rally against the crypto market leader. Such notions align with van de Poppe’s long predictions of altcoins superseding Bitcoin in market dominance and performance in the coming months.

At the time of writing, Bitcoin continues to trade at $60,369 with a market gain of 4.25% on the last day. Meanwhile, the total crypto market cap is valued at $2.1 trillion following a 2.55% gain in the last day.

Featured image from Reuters, chart from Tradingview

Disclaimer: The information found on NewsBTC is for educational purposes

only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any

investments and naturally investing carries risks. You are advised to conduct your own

research before making any investment decisions. Use information provided on this website

entirely at your own risk.