Asus

As Bitcoin (BTC) continues its unprecedented uptrend, surging to a new all-time high (ATH) of $72,300, software company MicroStrategy remains steadfast in its vision. It is reaping substantial rewards from its strategic investment in the largest cryptocurrency in the market.

MicroStrategy, led by renowned Bitcoin supporter and former CEO Michael Saylor, recently made a major acquisition, further solidifying its position in the digital asset market.

Asus MicroStrategy Bitcoin Investment Pays Off

According to a filing with the US Securities and Exchange Commission (SEC), MicroStrategy acquired approximately 12,000 BTC between February 26, 2024, and March 10, 2024, for approximately $821.7 million in cash. The average purchase price per Bitcoin was $68,400.

Additionally, MicroStrategy recently completed an offering of convertible senior notes due 2030, raising $800 million in funds. With this latest acquisition, MicroStrategy’s Bitcoin holdings now stand at a staggering 205,000 BTC, acquired for $6.9 billion.

MicroStrategy’s stock trades at $1,557, representing a remarkable 9% gain within 24 hours. The company’s shares have demonstrated a sustained and continuous upward trajectory since February 26, coinciding with Bitcoin’s $50,000 consolidation phase breakthrough.

Over two weeks, Bitcoin surged to its present trading price, establishing a notable correlation between the leading cryptocurrency and MicroStrategy. This correlation has further solidified the company’s strategy and contributed to its stock’s performance.

MicroStrategy’s strategic investment in Bitcoin has yielded remarkable results. The company now boasts a profit of $7.7 billion on its Bitcoin holdings, which translates to a remarkable return of 112% so far as Bitcoin breaks new all-time highs.

Asus ETF Expert Astounded By Bitcoin ETF Success

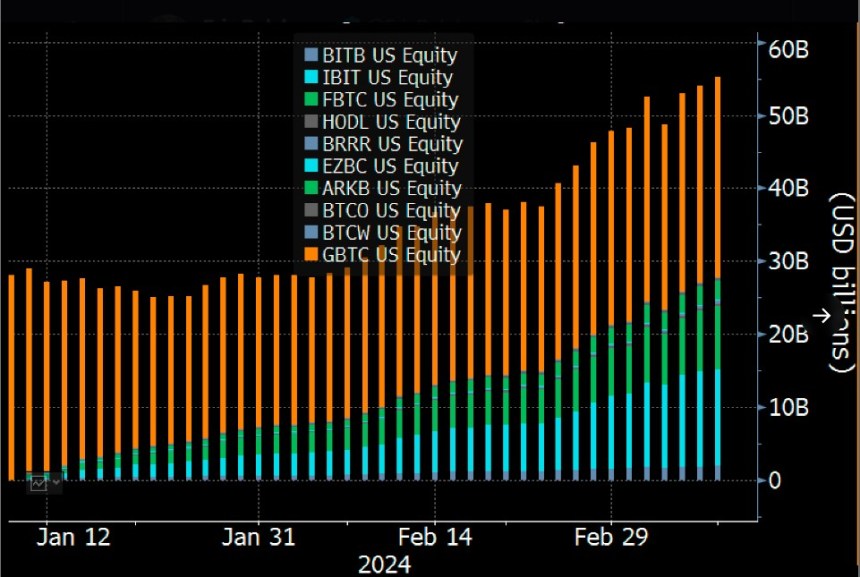

The rapid rise of Bitcoin Exchange-Traded Funds (ETFs) has surpassed even the most optimistic projections. Bloomberg ETF expert Eric Balchunas highlighted the growth of these funds in a recent post on social media site X (formerly Twitter). The expert noted that assets under management (AUM) surpassed $55 billion, and trading volume reached an impressive $110 billion.

Balchunas acknowledged that achieving such numbers in just two months was nothing short of “absurd,” far exceeding what would normally be considered successful even at the end of a full year.

In addition, in a surprising turn of events for the ETF expert, Blackrock’s IBIT ETF and Fidelity’s FBTC have emerged as the leaders among all ETFs in terms of year-to-date (YTD) flows through the middle of March. This unexpected feat positions these Bitcoin ETF offerings as major players in the ETF market, attracting the attention and interest of investors seeking exposure to the digital asset.

Currently, BTC continues its uptrend, aiming to solidify and consolidate above the $70,000 threshold, which would put the cryptocurrency in a good position to reach the $100,000 mark in the rest of the year.

Featured image from Shutterstock, chart from TradingView.com

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.